Macroeconomic

Improvements:

Macroeconomic

Improvements:

Japan's macroeconomic conditions are witnessing

positive changes. Moderate

inflation and a weak yen are

expected to boost

consumption and economic

growth. Recent data showing

significant wage growth,

potentially leading to

increased consumer spending,

and economic expansion. For

instance, Japan's monthly wage growth since 1997 suggests a favourable environment

for economic activity

Low Valuations and Upside

Potential:

Low Valuations and Upside

Potential:

Japanese equities are currently trading at

attractive valuations. With the market priced at around 12x earnings and 1.1x book

value, close to trough levels, there is considerable upside potential. Historically, the

market has rebounded quickly from such valuation levels, indicating a favourable

outlook for investors.

Attractive Currency

Dynamics:

Attractive Currency

Dynamics:

The weak yen presents a favourable environment for

foreign investors. Japan's currency remains one of the cheapest in developed markets,

encouraging foreign investment. A weak currency stimulates export-oriented

companies and promotes tourism, contributing positively to economic growth. For

instance, spending by tourists has historically contributed almost 1% to Japan's GDP.

Secular Growth Trends:

Secular Growth Trends:

: Japanese companies are well-positioned to capitalize on

global secular growth trends such as automation, digitization, online commerce, and

renewable energy. Japan hosts leading automation companies whose technology is in

high demand globally. Efforts to catch up in digitization and online commerce are

expected to drive growth across various sectors.

Improving Corporate

Governance:

Improving Corporate

Governance:

Corporate governance reforms in Japan are

addressing historical weaknesses in this area. Improved corporate governance is

expected to narrow the persistent discount in Japanese equities and drive higher

returns. Notably, Japanese companies have made progress in returning cash to

shareholders through dividends and buybacks.

Active Management

Opportunities:

Active Management

Opportunities:

The under-researched nature of Japanese

equities offers opportunities for active managers. Limited research coverage and

under-ownership by investors create opportunities for active managers to uncover

undervalued opportunities before the broader market. This presents a compelling

case for active management strategies in the Japanese market.

Japan's investment policy and support mechanisms reflect a concerted effort to

attract

foreign direct investment (FDI) and foster a conducive environment for investors.

Here's

an

overview based on the provided data:

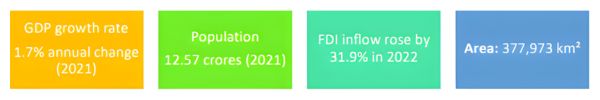

FDI Trends:

FDI Trends:

Japan has seen an increase in FDI inflows, reaching USD 32.5 billion in

2022, the highest level ever recorded. While FDI flows remain relatively low

compared to other developed nations, Japan ranks as the thirteenth-largest recipient

worldwide.

Legal and Regulatory

Environment:

Legal and Regulatory

Environment:

: Japan maintains a supportive legal and

regulatory framework for investors. Regulations are continually aligned with

international standards, providing a stable and predictable environment for

investment. Intellectual property rights are well-protected, with robust enforcement

mechanisms in place, ensuring the safety and security of investments.

Access to Capital

Markets:

Access to Capital

Markets:

Japan offers deep and accessible capital markets for

foreign investors. Nearly all foreign exchange transactions are freely permitted,

including profit transfers and capital repatriation. This accessibility enhances the

ease of doing business and facilitates efficient capital allocation.

Challenges and Reforms:

Challenges and Reforms:

Despite the favourable investment climate, challenges

persist, including historical reluctance towards mergers and acquisitions in Japanese

corporate culture and weak corporate governance leading to low returns on equity.

However, the government is actively addressing these issues through regulatory

reforms aimed at improving corporate governance standards and enhancing investor

confidence.

Labour Laws and

Recruitment:

Labour Laws and

Recruitment:

Japan's labour laws and recruitment systems present

challenges for investors, including inflexible regulations and a regimented system of

labour management. These factors contribute to increased costs and complexities in

human resource management. However, ongoing efforts to reform labour laws aim

to create a more flexible and business-friendly environment.

Investment Thresholds and

Notifications:

Investment Thresholds and

Notifications:

Japan imposes relatively few barriers to

foreign investment, with the main requirement being the submission of an ex post

facto report to relevant ministries. However, legislation introduced in 2020 reduced

the ownership threshold for pre-approval notification to the government for foreign

investors, particularly in industries deemed to pose potential risks to Japanese

national security.

Recognition and

Rankings:

Recognition and

Rankings:

Japan's favourable business climate is recognized

internationally, with high rankings in indices such as the Global Innovation Index and

the Index of Economic Freedom. Additionally, Japan ranks third in Kearney's Foreign

Direct Investment Confidence Index, reflecting investor confidence in the country's

investment environment.

Macroeconomic

Improvements:

Japan's macroeconomic conditions are witnessing

positive changes. Moderate

inflation and a weak yen are

expected to boost

consumption and economic

growth. Recent data showing

significant wage growth,

potentially leading to

increased consumer spending,

and economic expansion. For

instance, Japan's monthly wage growth since 1997 suggests a favourable environment

for economic activity

Macroeconomic

Improvements:

Japan's macroeconomic conditions are witnessing

positive changes. Moderate

inflation and a weak yen are

expected to boost

consumption and economic

growth. Recent data showing

significant wage growth,

potentially leading to

increased consumer spending,

and economic expansion. For

instance, Japan's monthly wage growth since 1997 suggests a favourable environment

for economic activity

Low Valuations and Upside

Potential:

Japanese equities are currently trading at

attractive valuations. With the market priced at around 12x earnings and 1.1x book

value, close to trough levels, there is considerable upside potential. Historically, the

market has rebounded quickly from such valuation levels, indicating a favourable

outlook for investors.

Low Valuations and Upside

Potential:

Japanese equities are currently trading at

attractive valuations. With the market priced at around 12x earnings and 1.1x book

value, close to trough levels, there is considerable upside potential. Historically, the

market has rebounded quickly from such valuation levels, indicating a favourable

outlook for investors.

Attractive Currency

Dynamics:

The weak yen presents a favourable environment for

foreign investors. Japan's currency remains one of the cheapest in developed markets,

encouraging foreign investment. A weak currency stimulates export-oriented

companies and promotes tourism, contributing positively to economic growth. For

instance, spending by tourists has historically contributed almost 1% to Japan's GDP.

Attractive Currency

Dynamics:

The weak yen presents a favourable environment for

foreign investors. Japan's currency remains one of the cheapest in developed markets,

encouraging foreign investment. A weak currency stimulates export-oriented

companies and promotes tourism, contributing positively to economic growth. For

instance, spending by tourists has historically contributed almost 1% to Japan's GDP.

Secular Growth Trends:

: Japanese companies are well-positioned to capitalize on

global secular growth trends such as automation, digitization, online commerce, and

renewable energy. Japan hosts leading automation companies whose technology is in

high demand globally. Efforts to catch up in digitization and online commerce are

expected to drive growth across various sectors.

Secular Growth Trends:

: Japanese companies are well-positioned to capitalize on

global secular growth trends such as automation, digitization, online commerce, and

renewable energy. Japan hosts leading automation companies whose technology is in

high demand globally. Efforts to catch up in digitization and online commerce are

expected to drive growth across various sectors.

Improving Corporate

Governance:

Corporate governance reforms in Japan are

addressing historical weaknesses in this area. Improved corporate governance is

expected to narrow the persistent discount in Japanese equities and drive higher

returns. Notably, Japanese companies have made progress in returning cash to

shareholders through dividends and buybacks.

Improving Corporate

Governance:

Corporate governance reforms in Japan are

addressing historical weaknesses in this area. Improved corporate governance is

expected to narrow the persistent discount in Japanese equities and drive higher

returns. Notably, Japanese companies have made progress in returning cash to

shareholders through dividends and buybacks.

Active Management

Opportunities:

The under-researched nature of Japanese

equities offers opportunities for active managers. Limited research coverage and

under-ownership by investors create opportunities for active managers to uncover

undervalued opportunities before the broader market. This presents a compelling

case for active management strategies in the Japanese market.

Active Management

Opportunities:

The under-researched nature of Japanese

equities offers opportunities for active managers. Limited research coverage and

under-ownership by investors create opportunities for active managers to uncover

undervalued opportunities before the broader market. This presents a compelling

case for active management strategies in the Japanese market.

FDI Trends:

Japan has seen an increase in FDI inflows, reaching USD 32.5 billion in

2022, the highest level ever recorded. While FDI flows remain relatively low

compared to other developed nations, Japan ranks as the thirteenth-largest recipient

worldwide.

FDI Trends:

Japan has seen an increase in FDI inflows, reaching USD 32.5 billion in

2022, the highest level ever recorded. While FDI flows remain relatively low

compared to other developed nations, Japan ranks as the thirteenth-largest recipient

worldwide.

Legal and Regulatory

Environment:

: Japan maintains a supportive legal and

regulatory framework for investors. Regulations are continually aligned with

international standards, providing a stable and predictable environment for

investment. Intellectual property rights are well-protected, with robust enforcement

mechanisms in place, ensuring the safety and security of investments.

Legal and Regulatory

Environment:

: Japan maintains a supportive legal and

regulatory framework for investors. Regulations are continually aligned with

international standards, providing a stable and predictable environment for

investment. Intellectual property rights are well-protected, with robust enforcement

mechanisms in place, ensuring the safety and security of investments.

Access to Capital

Markets:

Japan offers deep and accessible capital markets for

foreign investors. Nearly all foreign exchange transactions are freely permitted,

including profit transfers and capital repatriation. This accessibility enhances the

ease of doing business and facilitates efficient capital allocation.

Access to Capital

Markets:

Japan offers deep and accessible capital markets for

foreign investors. Nearly all foreign exchange transactions are freely permitted,

including profit transfers and capital repatriation. This accessibility enhances the

ease of doing business and facilitates efficient capital allocation.

Challenges and Reforms:

Despite the favourable investment climate, challenges

persist, including historical reluctance towards mergers and acquisitions in Japanese

corporate culture and weak corporate governance leading to low returns on equity.

However, the government is actively addressing these issues through regulatory

reforms aimed at improving corporate governance standards and enhancing investor

confidence.

Challenges and Reforms:

Despite the favourable investment climate, challenges

persist, including historical reluctance towards mergers and acquisitions in Japanese

corporate culture and weak corporate governance leading to low returns on equity.

However, the government is actively addressing these issues through regulatory

reforms aimed at improving corporate governance standards and enhancing investor

confidence.

Labour Laws and

Recruitment:

Japan's labour laws and recruitment systems present

challenges for investors, including inflexible regulations and a regimented system of

labour management. These factors contribute to increased costs and complexities in

human resource management. However, ongoing efforts to reform labour laws aim

to create a more flexible and business-friendly environment.

Labour Laws and

Recruitment:

Japan's labour laws and recruitment systems present

challenges for investors, including inflexible regulations and a regimented system of

labour management. These factors contribute to increased costs and complexities in

human resource management. However, ongoing efforts to reform labour laws aim

to create a more flexible and business-friendly environment.

Investment Thresholds and

Notifications:

Japan imposes relatively few barriers to

foreign investment, with the main requirement being the submission of an ex post

facto report to relevant ministries. However, legislation introduced in 2020 reduced

the ownership threshold for pre-approval notification to the government for foreign

investors, particularly in industries deemed to pose potential risks to Japanese

national security.

Investment Thresholds and

Notifications:

Japan imposes relatively few barriers to

foreign investment, with the main requirement being the submission of an ex post

facto report to relevant ministries. However, legislation introduced in 2020 reduced

the ownership threshold for pre-approval notification to the government for foreign

investors, particularly in industries deemed to pose potential risks to Japanese

national security.

Recognition and

Rankings:

Japan's favourable business climate is recognized

internationally, with high rankings in indices such as the Global Innovation Index and

the Index of Economic Freedom. Additionally, Japan ranks third in Kearney's Foreign

Direct Investment Confidence Index, reflecting investor confidence in the country's

investment environment.

Recognition and

Rankings:

Japan's favourable business climate is recognized

internationally, with high rankings in indices such as the Global Innovation Index and

the Index of Economic Freedom. Additionally, Japan ranks third in Kearney's Foreign

Direct Investment Confidence Index, reflecting investor confidence in the country's

investment environment.